What’s the impact of customers’ experiences on business growth?

The positive relationship between customer satisfaction and business revenue is well understood. Happy and satisfied customers are more likely to stick around, make repeat purchases, refer others to your business, and leave positive reviews, all of which can lead to increased revenue for your brand. On the other hand, dissatisfied customers are more likely to leave negative reviews, stop doing business with you, and even discourage others from buying from you, which will negatively impact your revenue.

A study by Temkin Group found that companies with high customer experience ratings generated a revenue growth rate that was 5.1 times higher than companies with poor customer experience ratings*. Similarly, an American Express study found that customers are willing to spend up to 17% more with companies that provide excellent customer service compared to companies with poor customer service*.

At inQuba we’ve seen that the effectiveness of a Customer Experience program is strongly influenced by the following:

- Real-time experience measurement across the customer journey

- Closed-loop service recovery

- Visibility of actionable results

- Stakeholder engagement

With these fundamentals in place, we’ve seen programs drive CSAT (customer satisfaction) up by almost 20% across industries, with meaningful improvements to NPS too.

Improving experiences through measurement and visibility

Our client, a rapidly growing P&C (short-term) insurtech that has grown to almost 1000 staff in the last 10 years, identified the opportunity to implement a CX change program that would include the following:

- Value measurement across the steps of the customer journey

- The ability to identify actionable improvement steps across operations and policy holder interactions

- The ability to act immediately on poor experiences

- The creation of a single view of every customer

- The ability to ensure relevant visibility across areas of the business and regions

- An effective foundation for Customer Journey Management

Having visibility of CX metrics across all areas of the business promotes alignment, accountability, collaboration, continuous improvement, and strategic decision making, all of which are critical for delivering a positive customer experience and driving business success.

How did we use experience visibility to improve experiences?

1/ The power of co-design

A CX program touches all areas of the business, and all customer experiences. In the case of this insurer, the program would measure and work to improve CSAT in multiple areas, including onboarding, NTUs (Not-Taken-Ups), claims, 3rd party services, support, and cancellation.

During design it’s important to ask: Who owns each experience point? All applicable stakeholders need to contribute to answering the following questions during design:

- Who is the owner of each experience point?

- What needs to be measured?

- What are the problem statements?

- What does success look like?

Insights gathered are then used to inform how experiences will be measured and how action will be taken to improve them.

2/ Real-time experience measurement at every step

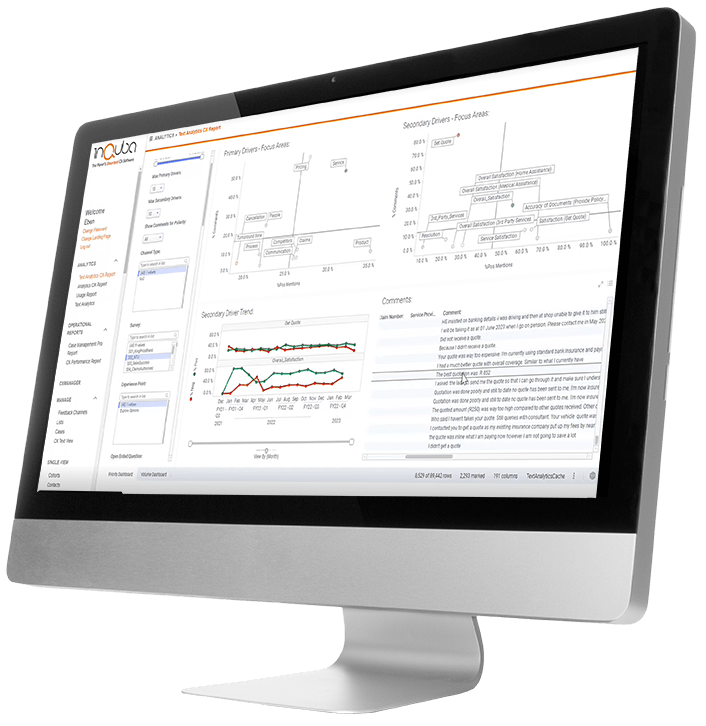

Feedback collection and experience measurement endeavor to understand satisfaction levels and the perception of value delivery at each step of the policy holders’ journey, as they journey with the brand. Several surveys were designed and implemented for each step:

- An NTU survey for those who did not accept the quote

- A success survey for those who accepted and proceeded to onboarding

- Claims surveys for authorized and rejected claims

- Post-servicing surveys

Analysis of the results revealed that there was room for improvement in the claims and servicing areas. Prior to the roll-out of the full program, results showed CSAT in the Servicing area was approximately 56%, and 62% in the Claims area.

Insurance customers are very price sensitive, so it wasn’t surprising to see ‘price’ and ‘affordability’ emerge as the top reasons for policies not being taken up. The Servicing survey, however, revealed that many unhappy policy holders were complaining about not having received the quote they asked for!

3/ Collaborative service recovery

Poor experiences happen and can even be anticipated. The crucial element is recovery. In fact, the way recovery takes place can even lift satisfaction levels to higher than before the service failure.

In this case, automated, rules-based, real-time case management ensured that negative feedback received resulted in an assigned case and an SLA. Cases were channeled automatically to the correct area of the business and received the appropriate attention by a service representative. Policy holders were contacted through their preferred channels, and the recovery activity was informed by policy holders’ individual profiles.

This was made possible by access to a dynamic customer profile – the single view of the customer. Other than contact details and policy information, this view also offers deep insight into customer activity, engagement, policy holder segment and sentiment, which empowers representatives with all the information they need before engaging.

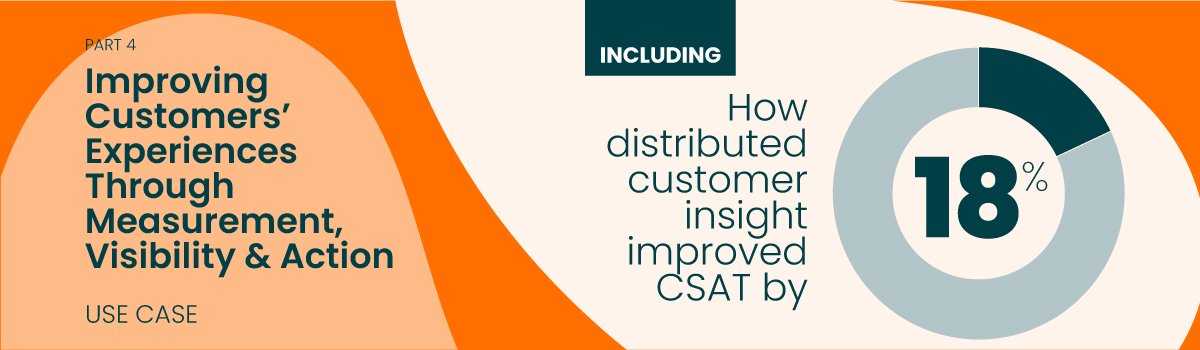

4/ Policy holder insight, distributed

Visibility of CX metrics across the business is important for the following reasons:

- Alignment: There’s general alignment on goals and objectives. It creates a shared understanding of what’s important from the customers’ experience.

- Accountability: Visibility ensures everyone is accountable for their contribution to the customers’ experience.

- Collaboration: Visibility creates collaboration across teams. This breaks down silos and encourages group think.

- Continuous improvement: Visibility helps the business to identify areas of poor improvement.

- Strategic decision making: Visibility enables the business to make strategic decisions that are customer-centric. High-impact initiatives can be prioritized.

In the case of our client, visibility was achieved through distributed dashboards. Dashboards were contextualized for each area of the business and geographic region. All project stakeholders received reports that were specific to their areas of responsibility, which could then be shared further.

These rich insights placed the customers’ experience at the center of the insurance business and established a common language and understanding of what was important. Insights were brought into shared forums where problem areas could be collaboratively discussed and solutions prioritized. And all strategies and interventions were tracked further against internal goals.

The result?

This institutional customer-centricity resulted in Servicing CSAT improving from 56% to 74%, and Claims CSAT improved from 62% to 73%.

Customer experience analytics is critical for understanding and improving the policy holder experience. By collecting, analyzing and distributing customer feedback, businesses can identify areas that need improvement, make data-driven decisions, and provide a better customer experience. Visibility can also help businesses increase customer loyalty, improve brand reputation, and boost revenue. Insurers investing in these programs can align internal goals with customer goals, and therefore stay competitive.

CX visibility allows for:

- Alignment

- Accountability

- Collaboration

- Continuous Improvement

- Strategic decision making

We would love to understand your business challenges and the problems you’re trying to solve. Reach out to us and we’ll set you up with an expert for a no-obligation discussion.

Guide customer behavior with inQuba Journey Management

Download our product paper now

Read the full 4-part Insurance series now.

References: